Basic Information

| Description | Value |

|---|---|

| ISIN | AT0000720008 |

| SYMBOL | TKA |

| REUTERS | TELA.VI |

| BLOOMBERG | TKA AV |

| Number of shares issued | 664.500.000* |

| Number of shares outstandig | 664.084.841** |

| Capital stock | EUR 1.449.274.500 |

| Listing | Vienna Stock Exchange |

* As of 26 November 2014 the number of shares has increased from 443.0 million to 664.5 million as a result of the capital increase.

** The company holds 415,159 of its own shares.

Share Price Info

We would be happy to send you information on the price of the Telekom Austria share. You will receive this information by e-mail. Please click on registration.

Analyst Coverage

| Institution | Phone / Email | Price Target | Rating |

|---|---|---|---|

| Alpha Value Jean-Michel Salvador | jm.salvador@alphavalue.eu +33 170611055 | 10.70 Apr 30, 2025 | buy Mar 7, 2023 |

| Bank Pekao Konrad Musial | konrad.musial@pekao.com.pl +48 603 059 375 | 9.70 Sep 24, 2024 | hold Sep 24, 2024 |

| Citigroup Rohit Modi | rohit1.modi@citi.com +44 207 986 6318 | 8.30 Jul 16, 2024 | hold Oct 26, 2023 |

| Erste Group Bank Nora Varga-Nagy | Nora.Varga-Nagy@erstegroup.com +43 (0) 50100 17416 | 9.40 Jan 21, 2025 | buy Jan 21, 2025 |

| JP Morgan Ajay Soni | ajay.soni@jpmorgan.com +44 (0) 203 493 8462 | 9.90 Apr 29, 2025 | hold May 30, 2024 |

| Kepler Cheuvreux Javier Borrachero | jborrachero@keplercheuvreux.com +34 91 436 5161 | 9.00 Apr 30, 2025 | hold Apr 30, 2025 |

| ODDO BHF Bojan Djurickovic | bojan.djurickovic@oddo-bhf.com +43 1 25 3121 6609 | 9.60 Feb 25, 2025 | hold Aug 5, 2024 |

| Bernstein Ulrich Rathe | ulrich.rathe@bernsteinsg.com +44 20 7762 5157 | 10.80 Feb 11, 2025 | buy Jun 12, 2024 |

| Deutsche Bank John Karidis | john.karidis@db.com +44 (0) 7818 093 258 | 11.00 June 19, 2025 | hold June 19, 2025 |

| Consensus Target Price | 9.82 |

As of June 19, 2025

Note: A1 does not assume any liability for the price targets and ratings displayed on this page.

Dividend Policy

The dividend policy aims at a reliable distribution with sustainable growth and long-term stability.

In 2023, an annual minimum dividend of EUR 0.32 was set.

The dividend payout is expected to grow sustainably in line with the operational and economic development of the Group.

A dividend of EUR 0.40 was paid out for the 2024 financial year on June 11, 2025. (2023: EUR 0.36)

| Year | Dividend per share (paid) | Earnings per Share (in reference year) | Free Cash Flow (in reference year) | Payout Ratio |

|---|---|---|---|---|

| 2025 | € 0.40 | € 0.94 | € 0.80 | 42.4% |

| 2024 | € 0.36 | € 0.97 | € 0.53 | 37.1% |

| 2023 | € 0.32 | € 0.95 | € 0.90 | 33.5% |

| 2022 | € 0.28 | € 0.68 | € 0.73 | 40.9% |

| 2021 | € 0.25 | € 0.58 | € 0.76 | 42.7% |

| 2020 | € 0.23 | € 0.49 | € 0.51 | 46.7% |

| 2019 | € 0.21 | € 0.36 | € 0.58 | 57.8% |

| 2018 | € 0.20 | € 0.48 | € 0.58 | 41.6% |

| 2017 | € 0.20 | € 0.58 | € 0.35 | 34.4% |

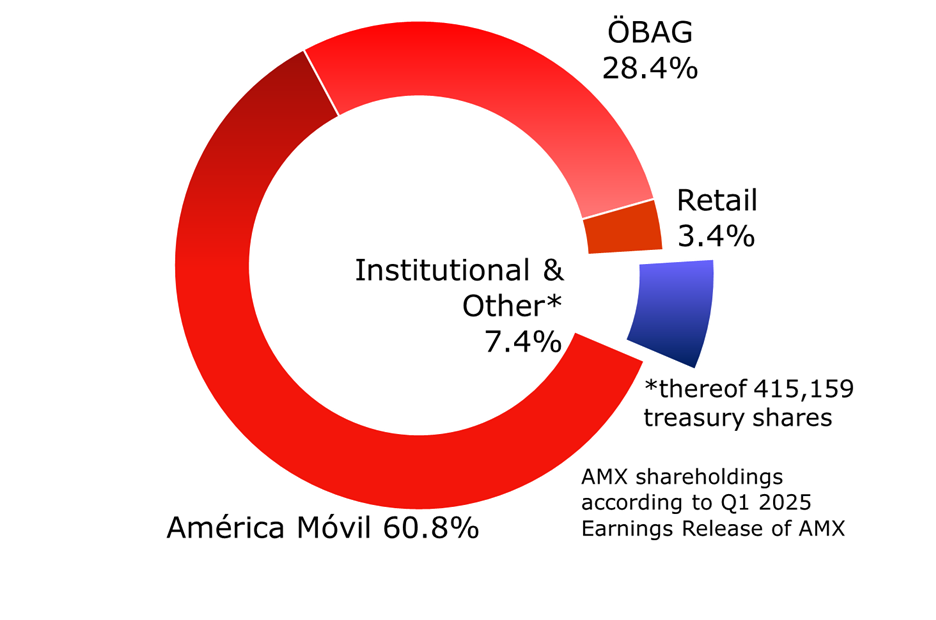

Shareholder Structure

Core Shareholders

América Móvil is the leading telecommunications company in Latin America, with total revenues of approximately EUR 41 billion*. The Group serves approximately 323 million mobile subscribers and 78 million RGUs. América Móvil is listed on the Mexican Stock Exchange and the NYSE.

ÖBAG (Österreichische Beteiligungs AG) is an independent holding company for state assets in Austria. Its mission is to preserve and grow its investments over generations. ÖBAG’s investment portfolio also includes: OMV, Verbund, Post, Casinos Austria, etc.

*calculated with period end FX rate

Major Holdings Notifications

Major Holdings are required if the share of voting rights in an issuer reaches, exceeds or falls below the following thresholds in the course of acquisitions, disposals or other transactions:

4%, 5%, 10%, 15%, 20%, 25 %, 30%, 35%, 40%, 45%, 50%, 75% or 90%.

Additional information and the FMA Web Standard Form can be found here.

Special Topics

Discover More

Corporate Governance

The Corporate Governance represents a set of rules for responsible management and control of a company and can thus be seen as a “Corporate Constitution”.

Capital market publications

Here you will find clearly arranged the most important reports and materials

IR Contact

Our IR team will be happy to assist you with any capital market-related questions or concerns.